Software doesn’t manage finance processes – it’s the other way round!

I’ve been engaged in the financial world for over 15 years, with the majority of the time spent on managing my own company Klaar.me. In these years, I’ve developed my own great passion – the digitalisation and automation of financial processes in respect of entire business processes. Why? Because I can see how much added value it actually brings and creates for companies.

As of now, Klaar.me is already an established quality label in accounting and much of our success has been forged thanks to our ability to see the big picture, bring forth systemic character, and digitalise and automate where possible. It seems like a great time for summaries and pointing out some excellent practical tips about the problems we face on a daily basis, along with the practical solutions for them. This article is especially recommended for managers of companies whose businesses have rapidly grown in the last few years or desire to accomplish growth!

Problem 1: The settlement process does not work. The most common case is when we are contacted by a client who has previously had their accounting done by a service provider who has not enabled access to the accounting software or who has copied the invoices one by one from the sales invoice software of the company into the accounting software and has certainly not reflected on the nature of the sales process at the financial process level.

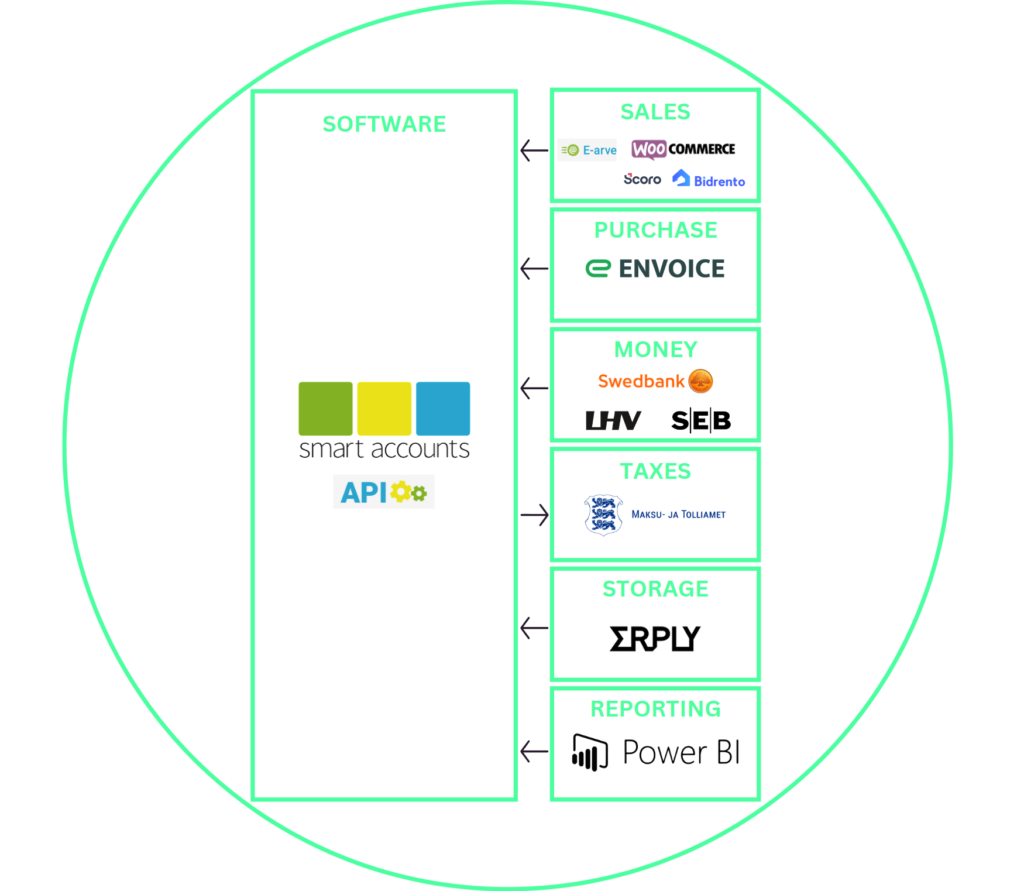

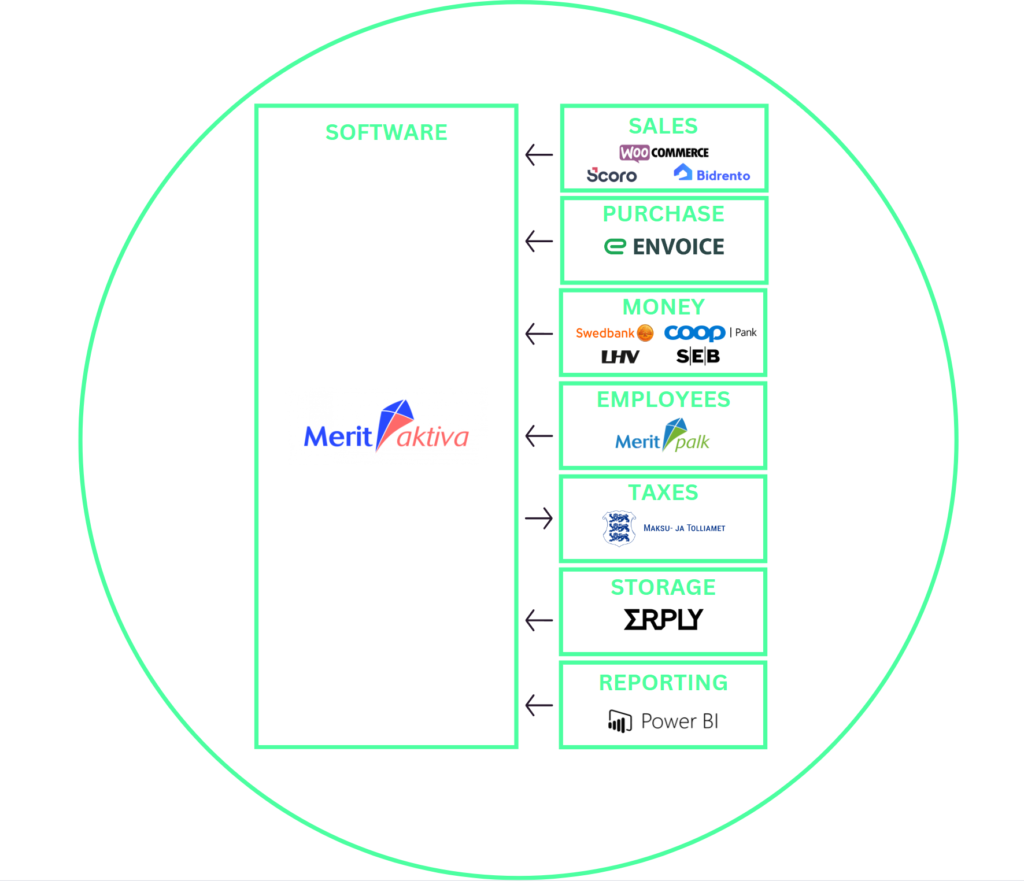

Klaar.me solution: We start from the beginning! First off, we discuss the actual needs of the business processes with the client, then we review whether the software currently used for the sales process is the best, and then we suggest suitable solutions. According to the area of activity of the client, the settlement process can be provided in different software: SmartAccounts, Merit, Stripe, Scoro, WooCommerce or Bidrento.

Problem 2: We use all the potentially cool software. Business manager: “I saw such a wild software solution and I’d like to implement it in our company – would you help me?”

Klaar.me solution: We get a fair share of such requests. Yes – there is actually a rather large variety of software being sold with fancy slogans. But there is no single universal solution for all companies, because business has so many nuances. In case of these requests, we first start unwinding the necessities of business processes and examining these nuances. It often becomes clear that the specific software may not suit the needs of the company that well and it’s not about any omissions in the software, but about the necessities of the company.

Problem 3: Accountant’s competence runs out. Little kids, little problems. Big kids, big problems. The same parallel can be drawn in business. We are often addressed by companies who are having trouble growing and whose accounting management has suddenly become overwhelming while there is insufficient in-house capacity and competence to bring it all under control.

Klaar.me solution: With Klaar.me, service provision always begins with mapping the current situation and negotiating the rules of the game. All parties have their own areas of responsibility that are clearly written down and defined – this avoids confusion and daily communication problems. Once the rules of the game have been laid down, it creates a favourable basis for growth, and if any teething problems occur, they are immediately visible. Our team includes an accountant, a higher level financial consultant (usually someone with an auditing background) and, if necessary, a financial controller and a financial manager.

Problem 4: Lack of financial picture. There have been cases when the CEO of a company reaches out to us and says that they no longer have a comprehensive overview. They’d like to make major business decisions, but they don’t have a clear financial picture.

Klaar.me solution: Once the accounting and finances are sorted, the clear picture of the actual situation of the company is also obvious! We love being systemic and having structure, and we build solutions that allow observing the actual status of the company in near-real-time. We’re moving towards data visualisation with Power BI software, with the managers of companies having the most to gain from it.

Problem 5: Wrong choice of accounting software. By wishing to be modern, managers of companies have decided to implement accounting software that isn’t suitable for the Estonian market at all, because they don’t consider the specific nature of the Estonian market, create inefficiencies, and fail to take into account the Estonian country-based tax accounting, payroll accounting and interfacing with Estonian banks and the Tax and Customs Board. Pretty soon, they’ll lose the comprehensive picture and reach out to Klaar.me.

Klaar.me solution: If you wish to change your accounting software or feel that the current software isn’t working out, request our consultation before making any major decisions. Based on our experience, we can say that wrong software decisions might eventually just waste tons of time and money.

Problem 6: Software interfacing doesn’t work. New software is implemented and interfaced without anyone assuming responsibility for the actual functioning of the interfacing. My experience shows that the prerequisite for making such major changes is involving a person in the interfacing with competence in higher financial processes and additional awareness of IT. Why? Because software itself doesn’t assume responsibility for the actual functioning of the financial process of the company once the interfacing is switched on.

Klaar.me solution: We have all the required competences in our company in order to implement the modern range of software, taking into consideration the needs of the company, and for managing the processes as they should be managed. In addition to higher financial awareness and accounting, we also have IT competence in the company, whom we involve in our software interfacing.

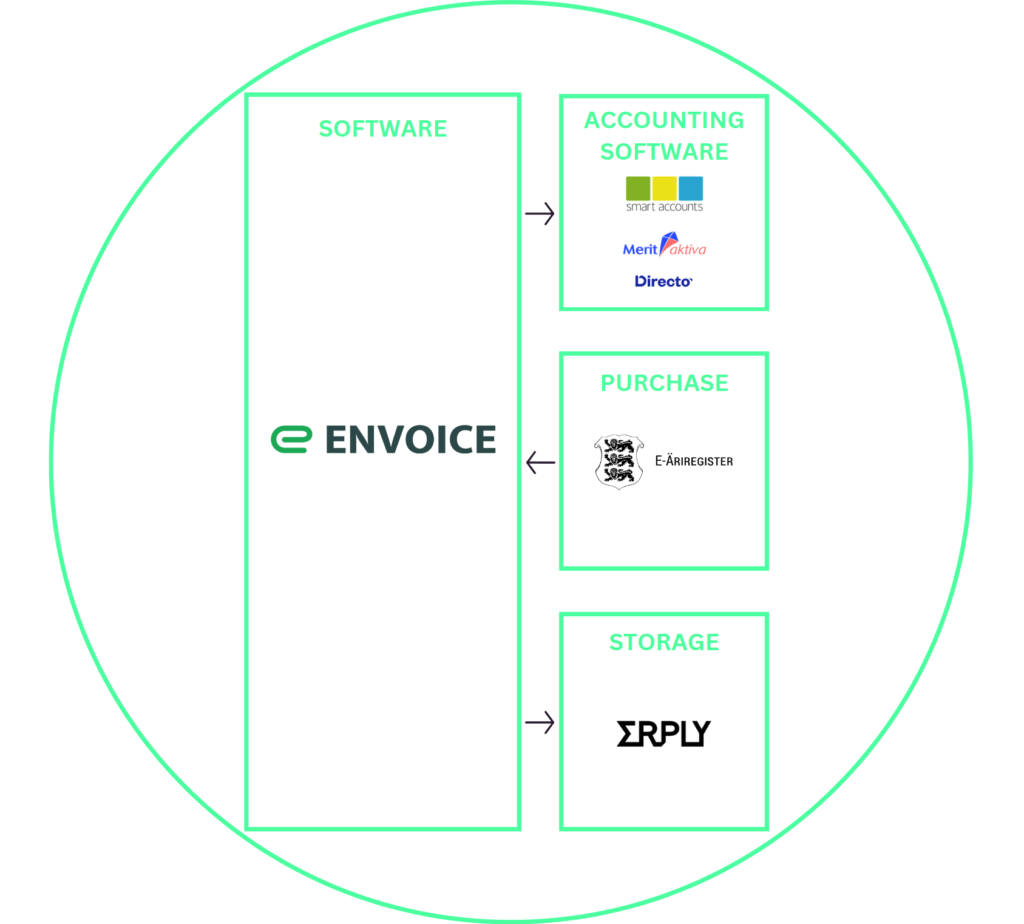

And here’s a short handbook on the software interfacing we currently work with. Take a look whether you’re missing a factor or link.